September 9, 2021

Economic progress report: Monetary policy for the recovery

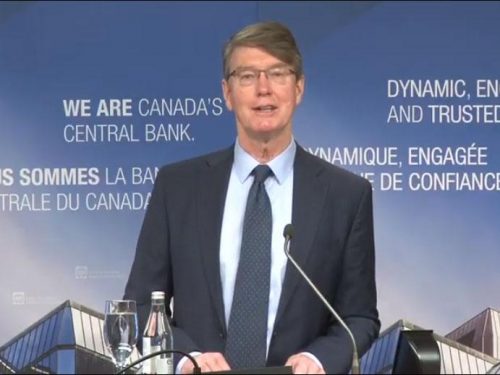

Bank of Canada Governor Tiff Macklem talks about the Bank’s latest interest rate announcement and discusses how the Bank could adjust monetary policy and its quantitative easing program as the recovery progresses.