Charlottetown, Prince Edward Island

-

November 26, 2024

Speech: Greater Charlottetown Area Chamber of Commerce

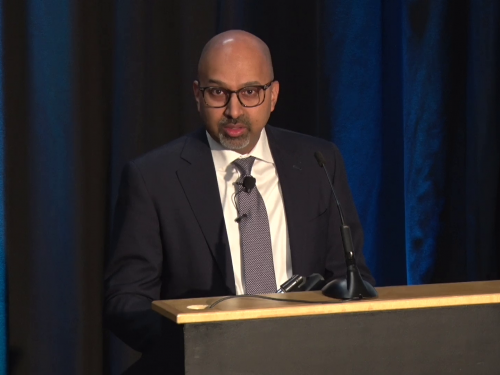

Inflation at 2%: the role of monetary policy going forward — Deputy Governor Rhys Mendes speaks before the Greater Charlottetown Area Chamber of Commerce (8:20 (ET) approx.) .

-

November 26, 2024In his first public speech as a deputy governor, Rhys Mendes explains why higher interest rates were needed to get inflation back down to the 2% target and why we want it to stay there.

-

November 26, 2024

Sticking the landing: Keeping inflation at 2%

Deputy Governor Rhys Mendes discusses how monetary policy worked to bring inflation back down to target and why the Bank wants inflation to stay close to 2%. -

May 19, 2015

Greater Charlottetown Area Chamber of Commerce - Press Conference (Audio)

The Way Home: Reading the Economic Signs - Stephen S. Poloz, the Governor of the Bank of Canada, speaks before the Greater Charlottetown Area Chamber of Commerce (13:00 (ET) approx.)

-

May 19, 2015

Greater Charlottetown Area Chamber of Commerce - Press Conference (Video)

The Way Home: Reading the Economic Signs - Stephen S. Poloz, the Governor of the Bank of Canada, speaks before the Greater Charlottetown Area Chamber of Commerce (13:00 (ET) approx.)

-

May 19, 2015

Canadian economy rebuilding, though headwinds remain, says Governor Poloz

Following a setback caused by the drop in oil prices, the Canadian economy is once again on a course toward sustainable balanced growth, although it continues to face headwinds, Bank of Canada Governor Stephen S. Poloz said today. The Governor’s speech to the Greater Charlottetown Area Chamber of Commerce outlined some key indicators the Bank […] -

May 19, 2015

Greater Charlottetown Area Chamber of Commerce - Speech (Audio)

The Way Home: Reading the Economic Signs - Stephen S. Poloz, the Governor of the Bank of Canada, speaks before the Greater Charlottetown Area Chamber of Commerce (11:45 (ET) approx.)

-

May 19, 2015

Greater Charlottetown Area Chamber of Commerce - Speech (Video)

The Way Home: Reading the Economic Signs - Stephen S. Poloz, the Governor of the Bank of Canada, speaks before the Greater Charlottetown Area Chamber of Commerce (11:45 (ET) approx.)

-

May 19, 2015

The Way Home: Reading the Economic Signs

Governor Poloz discusses some key indicators the Bank is watching as the Canadian economy heads toward sustainable balanced growth. -

June 27, 2014

A Dual Vision for the Canadian Payments System

Deputy Governor Lawrence Schembri calls for a collaborative approach to achieving a payments system that is innovative, safe, and efficient.