June 2, 2022

Zone économie on Radio-Canada

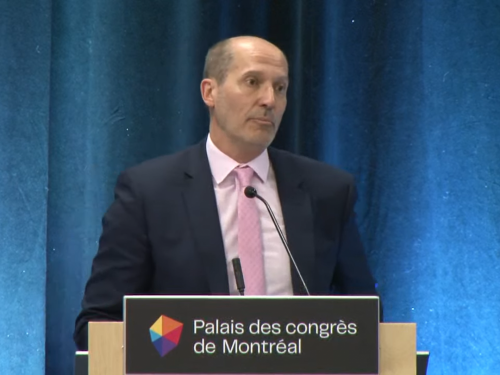

Paul Beaudry, Deputy Governor of the Bank of Canada

Interview with Zone économie on Radio-Canada