Find out what “legal tender” means, why legal tender status changes, and how to redeem older bank notes.

What “legal tender” means

Bank notes issued by the Bank of Canada, together with coins issued by the Royal Canadian Mint, are what is known as “legal tender.” That’s a technical term meaning the Government of Canada has deemed them to be the official money we use in our country. In legal terms, it means “the money approved in a country for paying debts.”

Today, money is not just bank notes or coins. It takes many different forms, including credit cards, debit cards, cheques, and the contactless payments we make using mobile devices. You can pay with any of these forms of money, even though they are not considered “legal tender.” In fact, anything can be used if the buyer and seller agree on the form of payment.

Not all bank notes are legal tender

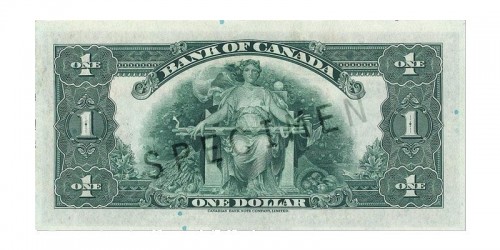

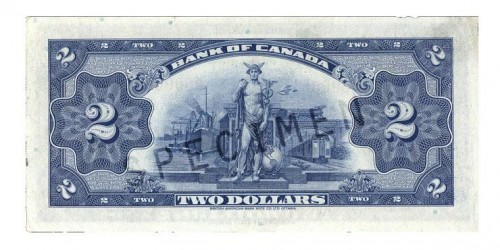

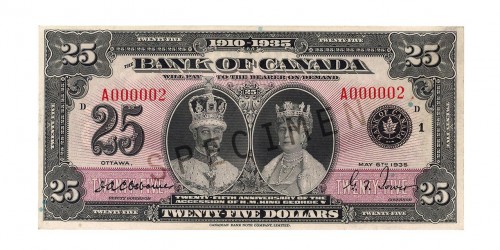

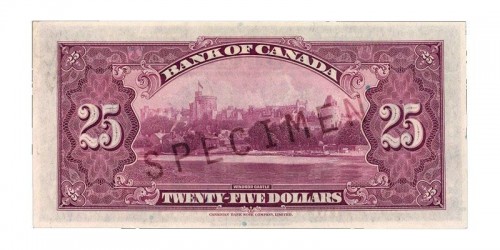

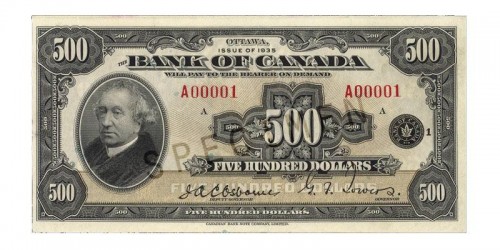

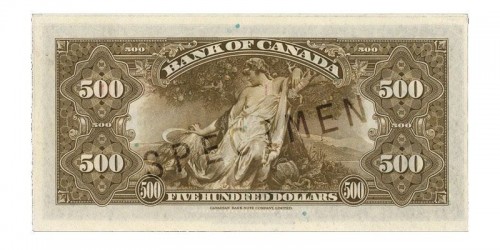

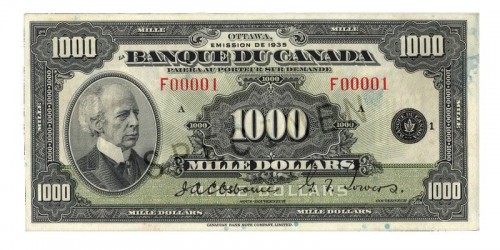

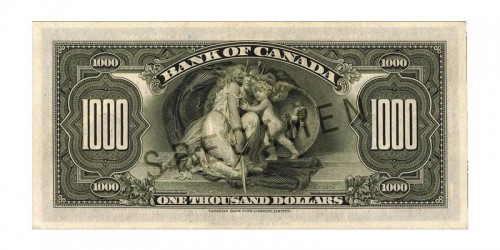

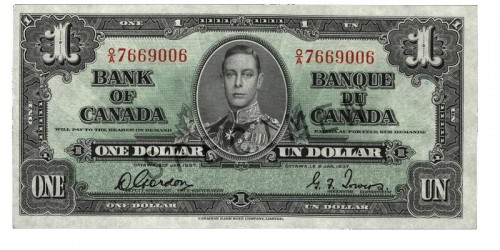

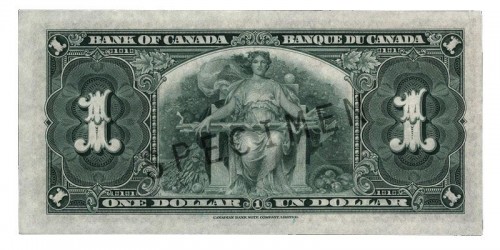

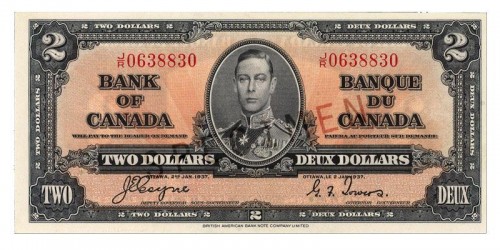

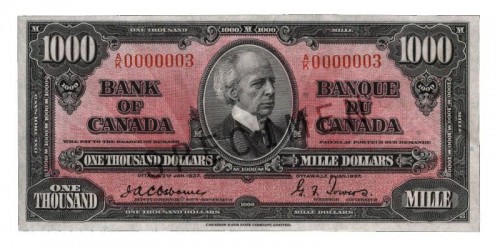

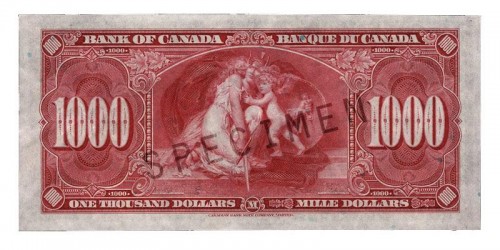

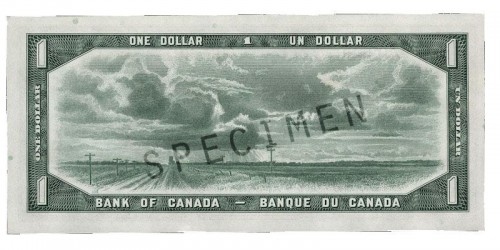

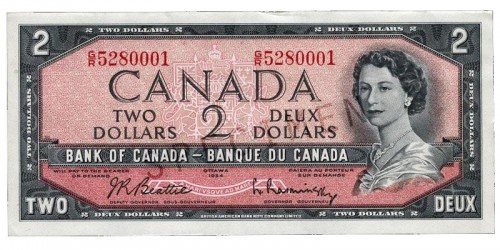

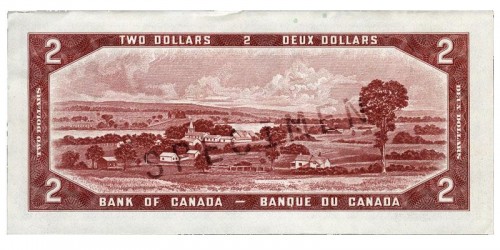

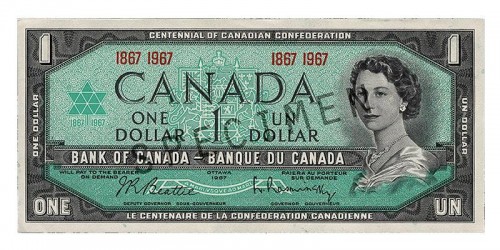

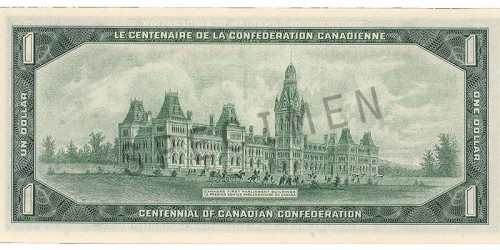

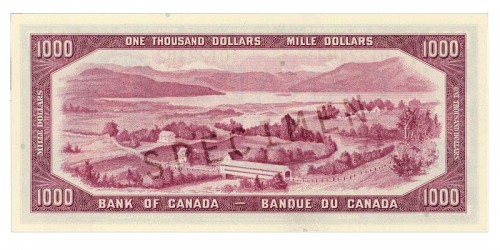

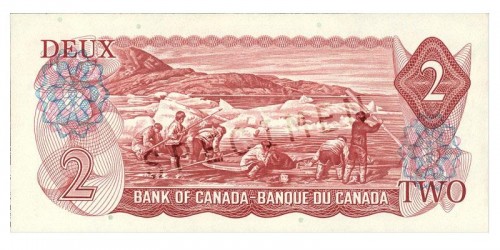

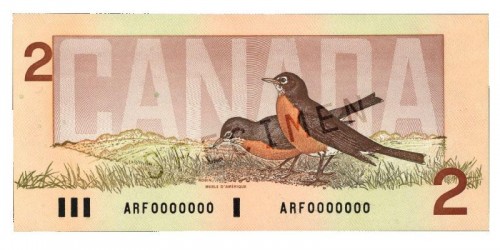

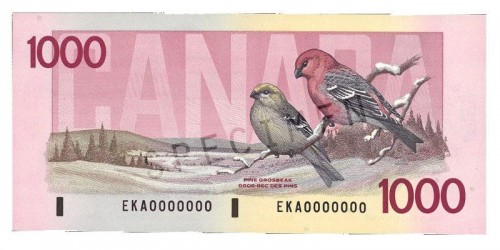

As of January 1, 2021, the $1, $2, $25, $500 and $1,000 bills from every Bank of Canada series are no longer legal tender.

These bank notes have not been produced in decades, so the decision to remove them from circulation has had little impact on most of us.

- The $1 and the $2 notes stopped being issued in 1989 and 1996, respectively, and were replaced with coins.

- The $25 note was a commemorative note. Both it and the $500 note were discontinued shortly after they were issued in 1935.

- The $1,000 note stopped being issued in 2000.

Removing legal tender status from these bills means that they are no longer considered money. Essentially, you may no longer be able to spend them in a cash transaction. This does not mean that the notes are worthless. The Bank of Canada will continue to honour them at face value.

Why legal tender status changes

Amendments to the Bank of Canada Act and the Currency Act approved by Parliament in 2018 gave the Government of Canada the power to remove legal tender status from bank notes—something it could not do before.

The Minister of Finance is responsible for both the Bank of Canada Act and the Currency Act, and the changes made to allow the removal of legal tender status from bank notes were initiated by the Minister in consultation with the Bank of Canada and other agencies. The Bank fully supports the amendments.

Having the power to remove legal tender status from bank notes is a way to complete their removal from circulation and to help ensure that Canadians have access to the most current and secure bank notes. It also guarantees they are always easy to spend since recent notes are more recognizable to merchants.

The government currently has no plans to take any bank notes other than the $1, $2, $25, $500 and $1,000 notes out of circulation. It will be able to remove other notes in the future as needed.

What other countries do

Many other countries officially remove old notes from circulation. More than 20 central banks around the world have the power to remove legal tender status from their notes. These include:

- Bank of England

- Sveriges Riksbank (Sweden)

- Norges Bank (Norway)

- European Central Bank

- Swiss National Bank

- Reserve Bank of New Zealand

Some central banks demonetize bank notes after legal tender status has been removed, which means that they cease to honour their face value. In other words, demonetized bank notes lose their value.

There are currently no plans or legal means to demonetize bank notes in Canada.

How to redeem older bank notes

The $1, $2, $25, $500 and $1,000 bills still retain their face value even though they are no longer legal tender. You can take them to your financial institution or send them to the Bank of Canada to redeem them.

Or, you can decide to keep them.

Legal tender status as of January 1, 2021

As of January 1, 2021, the $1, $2, $25, $500 and $1,000 bills from every series are no longer legal tender.