Canada’s mortgage market should evolve to offer more choice with less risk, Bank of Canada Governor Poloz says

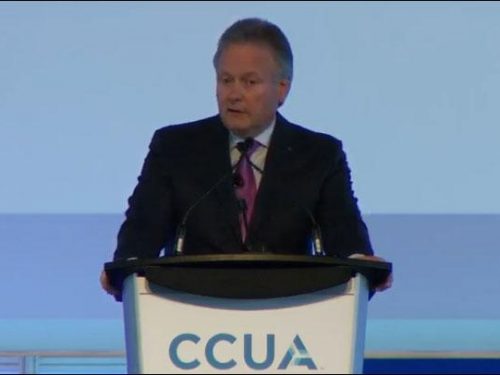

Canada’s mortgage market should evolve in a way that gives Canadians more choice and helps the economy be more flexible, while lowering the level of risk in the system, Bank of Canada Governor Stephen S. Poloz said today.

Financial flexibility and the proper sharing of risk are important because they help people adapt to changing circumstances and the economy adjust to shocks, Governor Poloz said in a speech to the Canadian Credit Union Association and Winnipeg Chamber of Commerce. These issues become particularly relevant for people when they buy a house and take out a mortgage.

Governor Poloz reviewed recent developments in housing markets across Canada. “The big rise and fall in housing resale activity in British Columbia and Ontario can mostly be explained by shifts in house price expectations,” the Governor said, suggesting that those markets were seeing a significant amount of froth.

“When those price expectations are revised down, demand for houses can cool suddenly,” the Governor said. “The trigger could be anything, including new taxes on foreign buyers, stricter mortgage guidelines, rising interest rates, or simply that rising prices create an affordability roadblock for more and more people.”

“The Bank of Canada is continuing to watch closely how housing markets are adjusting,” the Governor added. “Some previously frothy markets are still adjusting to a significant shift in price expectations, while other markets appear to be operating in a manner consistent with market fundamentals. As markets stabilize in Toronto and Vancouver, the Canadian housing sector should return to growth overall later this year.”

While Canadian homeowners and financial institutions have been well-served by our mortgage market, “we could look at ways to develop a more flexible mortgage market that gives more choice to customers, lenders and investors, while making the market safer and more efficient,” Governor Poloz said.

The Governor discussed three areas where Canada’s mortgage market could be made more flexible: diversifying mortgage terms to encourage longer loan terms, developing a market for private mortgage-backed securities, and encouraging different mortgage designs. This includes shared equity mortgages, which should help improve the resilience of the financial system and the economy’s ability to adjust to shocks.

It is “important to think about ways to innovate and make a good system better so that borrowers and lenders can make choices that better suit their circumstances,” Governor Poloz said.