Introduction

Foreign demand for Government of Canada (GoC) bonds has increased rapidly since the financial crisis. This sudden interest by foreigners in the GoC market is associated with external events, such as the implementation of quantitative easing (QE) by the Federal Reserve in 2008 and the euro crisis that began in 2010. More importantly, this foreign interest reflected Canada’s newly achieved status as a safe haven. Foreign purchases were large both by historical standards and relative to the market size of GoC bonds. We estimate that foreign purchases of approximately $150 billion of GoC bonds lowered the 10-year yield by 100 basis points between 2009 and 2012. We also show that the decline in yields was mainly the result of lower risk premiums rather than reduced expectations of future short-term interest rates.

The long-running debate about the effects of capital flows has intensified recently in the wake of QE. While much of the debate emphasizes the spillover effects of QE on emerging-market economies (EMEs), we complement this work by examining the effects of recent capital flows on the prices of long-term GoC bonds. Understanding the effects of these flows on Canadian asset prices is important, since

- a lower term premium encourages investment growth in Canada, but

- overinvestment by foreign investors can lead to inefficient allocation of capital, and

- a greater role for foreign investors in domestic markets could introduce a vulnerability to large outflows, which could increase debt-service costs for Canadians through a higher term premium, as highlighted in recent issues of the Bank of Canada Financial System Review.1

The rest of the discussion is organized as follows. For background, Section 2 provides a summary of recent trends in capital flows into Canada. Section 3 presents results from the empirical analysis of the effects of these flows on the price of 10-year GoC bonds, and Section 4 concludes.

Recent Trends in Investment Flows into Canada

The GoC bond market is large, liquid and safe. As of May 2015, GoC treasury bills and bonds outstanding totalled $637 billion and, since 2004, they have carried a triple-A rating (the highest credit ranking) from all agencies. The GoC market is also considered highly liquid by global standards, with effective bid-ask spreads comparable with those of other highly liquid assets, such as U.S. Treasuries or German Bunds.

Since late 2008, net portfolio investment in Canadian federal government bonds by foreign investors has increased to a record level.2 By the end of 2012, foreign investors had purchased around $150 billion of GoC bills and bonds, doubling their share of total outstanding bonds from 15 per cent in late 2008. Such a large and swift change in their relative holdings is, in part, a reflection of two major global events.

First, the implementation of QE programs by the Federal Reserve is associated with large cash flows into Canada (Chart 1). Since 2009, QE has significantly reduced the net supply of long-duration assets such as U.S. Treasuries, thereby reducing their yields through lower risk premiums (Gagnon et al. 2010). This prompted investors to look for substitutes abroad, and, as a result, term premiums were lowered in other economies, including Germany, Australia and Canada (Bauer and Neely 2013). Indeed, GoC bond yields began to track both the level and movement of U.S. Treasury yields much more closely than in the past. Second, the onset of the euro crisis in 2010 was also associated with major flows into the GoC bond market. Concerns about debt sustainability in Europe led global investors away from European assets and toward more safe and liquid assets, including Canadian government debt.

Chart 1: Canadian long-term rates have been driven by key external events

The size and persistence of flows since 2009 are large by historical standards. Chart 2 reports annual flows since 1991, showing that the flows before the crisis were much smaller, even during the mid-1990s, when the stock of debt was large relative to GDP. The change is due, in part, to Canada’s newly attained safe-haven status, which made Canadian assets such as GoC bonds particularly attractive during times of market turmoil. In fact, a recent Bank of Canada study suggests that there has been increased demand for Canadian government securities by foreign reserve managers (Pomorski, Rivadeneyra and Wolfe 2014). The onset of the euro crisis caused the euro, one of the traditional reserve currencies, to drop sharply in value, leading reserve managers to consider non-traditional assets such as the Canadian dollar.

Chart 2: Net annual purchases of GoC bills and bonds by foreign investors

Investment Flows and Long-Term Bond Yields

Foreign investments in GoC bonds grew rapidly, outpacing the growth rate of GoC debt. When this happens, the relative supply of GoC bonds declines, and foreign investors must offer a higher price (lower yield) to domestic investors to induce them to sell their holdings. This price premium represents compensation for domestic investors, who must now acquire another asset with similar characteristics. This is particularly the case for so-called “preferred-habitat investors,” such as pension funds, which have historically been large holders of GoC bonds.

Quantifying the relationship between flows and yield to assess how much GoC bond yields were affected by investment flows from abroad is a challenging task, owing to the extremely volatile nature of flow data. Smoothing the data by using a rolling sum is a possible solution, but this approach is backward-looking. To circumvent this weakness, we extract a forward-looking estimate of the persistent component hidden in monthly bond flows using a VARMA model3 (Chart 3). We use the model to perform an impulse-response analysis by evaluating the response of GoC 10-year yields when there is a shock to the persistent component of foreign flows.

Chart 3: Forward-looking estimate of the persistent component of bond flows

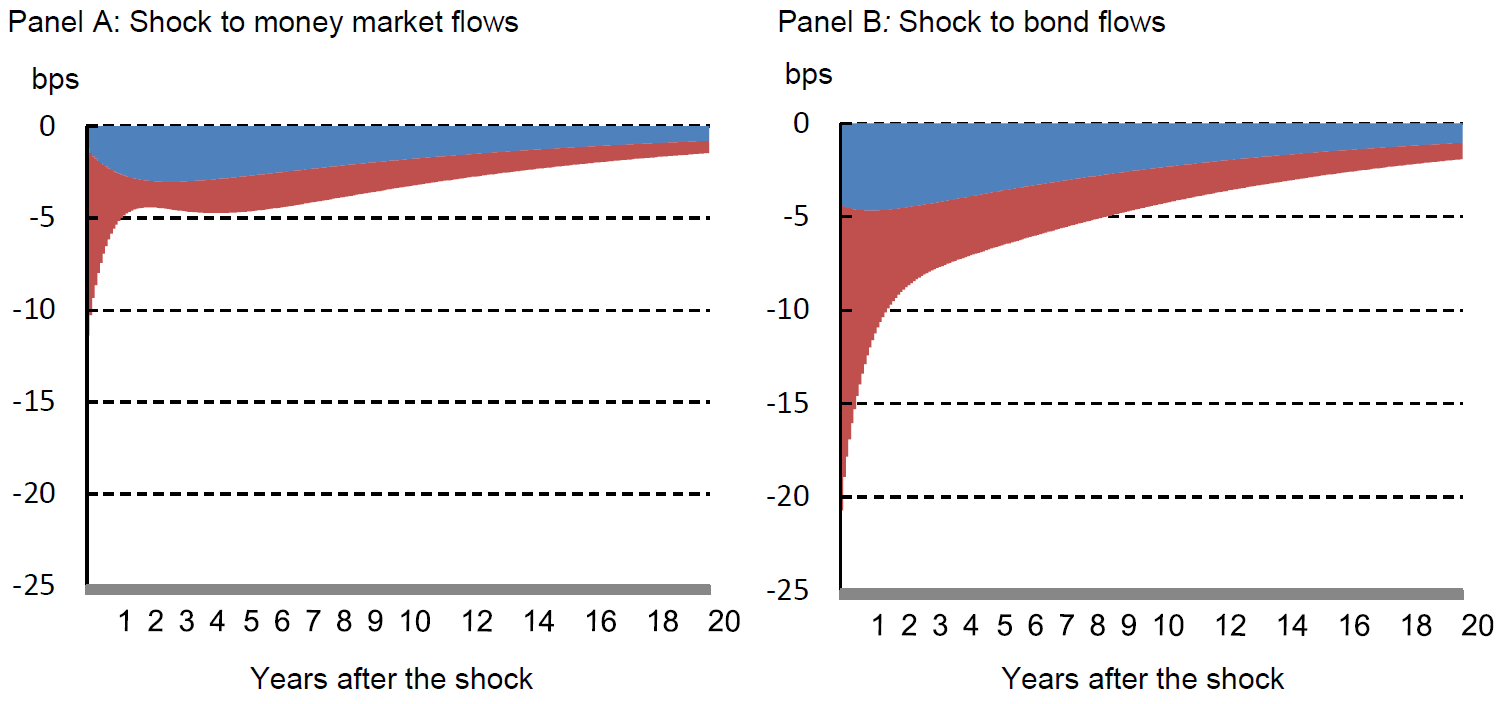

We find a significant relationship between the 10-year yield and the persistent component of flows (Chart 4). Our estimates imply that net inflows reduced the Canadian 10-year yield by approximately 100 basis points between 2009 and 2012. In addition, foreign flows almost fully accounted for the 70 basis-point change in the 10-year yield during the May 2013 “taper tantrum” event4.

The estimates can also be decomposed into the term premium component and the expectation of short term rates component. If flows into Canada reflect an international portfolio rebalancing effect due to U.S. QE or a flight-to-safety from Europe, we would expect the term premium to be the component that is relatively more affected. Indeed, Chart 4 shows that a larger share of the impact is attributed to the term premium. This supports our intuition that GoC bonds have been regarded as substitutes for U.S. Treasuries or safe-haven assets during the post-crisis period.

Chart 4: Impact on the GoC 10-year yield of one standard deviation shock to flows

Chart 4: Impact on the GoC 10-year yield of one standard deviation shock to flows

Note: Money market flows represent flows into federal government securities with maturities of less than one year, whereas bond flows represent federal government securities with maturities longer than one year. The blue area represents the impact on the expectations component; the red area represents the effect on the term-premium component.

The time variation in foreign flows before the financial crisis was small and therefore did not exhibit a clear relationship with yields. This suggests that the increased explanatory power of foreign flows is a recent fenomenon and that this is likely due to the global events noted above.

Concluding Remarks

Foreign investors amassed a significant amount of GoC bonds following the crisis, and our findings indicate that they exerted significant downward pressure on Canadian long-term yields. While the future behaviour of flows is very difficult to determine, it is clear that portfolio-allocation decisions from abroad are now playing an increasingly important role in the variations in GoC bond prices. This may also apply to other Canadian asset classes going forward. Chart 5 shows that there has been an increase in foreign demand for Canadian corporate debt as well as for Canadian equities in the post-crisis period, although the magnitude of these flows was not as big as that of the flows into the GoC market. Nevertheless, these flows were very persistent, and, lately, these asset classes appear to be garnering more interest from abroad.

Chart 5: Foreign investors continue to show strong demand for Canadian assets

Appendix

The unemployment rate and closing yields on the last business day of the month are from the Bank of Canada. Data on net foreign purchases (gross purchases minus sales) of Canadian Government securities are from Statistics Canada’s series on international transactions in securities, CANSIM Table 376-0131. The figures are recorded at market value and include gross purchases and sales by foreign residents on a monthly basis. The figures exclude securities held as part of Canada’s official international reserves. The values used are transaction prices and do not include fees or commissions.

All variables are measured on a monthly basis from January 1990 to November 2014. In addition to the nominal 10-year yield and foreign flows into GoC bonds and money market instruments, our state vector (X) includes the nominal 1-year yield and the unemployment rate. By adding these variables, we control for factors that are widely known to affect the dynamics of long-term yields. We assume that our state vector (X) follows a vector autoregressive moving average (VARMA) dynamic:

Using an impulse-response analysis, we analyzed how the GoC 10-year yields behaved over time when there was a one standard deviation shock in the persistent component of foreign flows. For example, our model estimates a 20-basis-point change in the GoC 10-year yield when there is a one standard deviation shock in the persistent component of bond flows (Chart 4). Since we observe that the average level of the persistent component of flows in the post-crisis period was higher than the average level in the pre-crisis period by five standard deviations, we were able to infer that net inflows since the crisis reduced the yield by approximately 100 basis points.

The estimate of the impact was decomposed by computing the expectation of short-term rates. This is done by first regressing the 1-month GoC yield on our state vector (X). Then, the coefficient estimate of X is multiplied to its expected value (E[X]) to compute the expectation of future short-term rates. The impact on the term premium can then be computed by subtracting the change in the expectation of short-term rates from the total impact estimated.

Endnotes

- 1. Bank of Canada Financial System Review, June 2015.[←]

- 2. See the Appendix for precise definitions of the data used.[←]

- 3. Feunou and Fontaine (2014) employ a similar methodology to extract inflation expectations from the volatile inflation series.[←]

- 4. The term “taper tantrum” has been widely used to define how markets reacted to comments by Federal Reserve Chairman Ben Bernanke that the Fed might slow down, or taper, the rate of bond purchases, which is part of its quantitative easing (economic stimulus) program.[←]

References

- Bank of Canada. 2015. Financial System Review (June).

- Bauer, M. D. and C. J. Neely. 2013. “International Channels of the Fed’s Unconventional Monetary Policy.” Federal Reserve Bank of San Francisco Working Paper No. 2012-12.

- Feunou, B. and J.-S. Fontaine 2014. “Non-Markov Gaussian Term Structure Models: The Case of Inflation.” Review of Finance 18 (5): 1953–2001.

- Gagnon, J., M. Raskin, J. Remache and B. Sack. 2010. “Large-Scale Asset Purchases by the Federal Reserve: Did They Work?” Federal Reserve Bank of New York Staff Report No. 441.

- Pomorski, L., F. Rivadeneyra and E. Wolfe. 2014. “The Canadian Dollar as a Reserve Currency.” Bank of Canada Review (Spring): 1–11.

On this page

Acknowledgements

We are grateful for conversations with Ian Christensen and Natasha Khan. Thanks also to Maura Brown for editorial support.

Disclaimer

Bank of Canada staff analytical notes are short articles that focus on topical issues relevant to the current economic and financial context, produced independently from the Bank’s Governing Council. This work may support or challenge prevailing policy orthodoxy. Therefore, the views expressed in this note are solely those of the authors and may differ from official Bank of Canada views. No responsibility for them should be attributed to the Bank.

DOI: https://doi.org/10.34989/san-2015-1