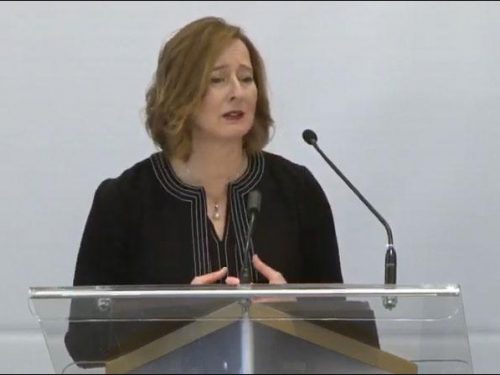

Canada’s financial system is resilient amid global uncertainty, Senior Deputy Governor Wilkins says

The Canadian financial system and economy are in good shape to deal with whatever storms might arise from a weakening global context, Senior Deputy Governor Carolyn A. Wilkins said today.

In remarks to the International Finance Club of Montréal, Wilkins noted that threats such as the trade war and financial vulnerabilities—which include worldwide debt levels that are higher than before the Great Recession—are key sources of economic uncertainty and financial stress.

“The global context has worsened, increasing risks to the global expansion and the chances of financial stress,” Wilkins said.

Still, the Canadian financial system is highly resilient, she added. The Bank of Canada and other authorities have put in place measures to strengthen our banking system. As well, changes to mortgage finance rules, various local tax measures and higher interest rates have helped Canada make progress in dealing with vulnerabilities such as high levels of household debt.

“In the unlikely event of a storm, Canada’s financial system is resilient, and we are in a good position to deal with whatever comes our way,” Wilkins said.

However, Wilkins cautioned against complacency. “This is not the time to let our guard down,” she said. “Robust defences are especially important when difficulties abroad could affect us at home.”

Wilkins also outlined the Bank’s research plan to better understand how climate change risks impact the Bank’s forecasting and policy work and how severe weather events and the transition to a low-carbon economy could affect Canada’s financial system.

“This is the start of a long journey, and we are partnering with others to make progress,” Wilkins said. The Bank is “engaging with others to better understand how companies and investors are assessing and mitigating climate risks.”