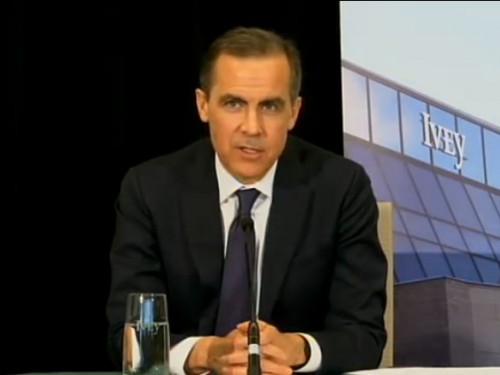

Rebuilding trust in banking is vital to improving the pace of global economic recovery, says Bank of Canada Governor Mark Carney

While much progress has been made reforming the global financial system, to restore fully trust in banking there remains a fundamental need for financial institutions to rediscover their core values, Bank of Canada Governor Mark Carney said today in a speech at Western University in London, Ontario.

The real economy relies on the financial system, and the financial system depends on trust. The widespread loss of trust in banks has both “deepened the cost of the crisis and is restraining the pace of the recovery,” said the Governor.

The costs of not restoring this trust are potentially enormous, since a fragmented financial system could ultimately “reverse the process of global economic integration that has supported growth and widespread poverty reduction over the last two decades.”

The G-20’s comprehensive, global financial reform agenda goes a long way to restoring that trust, but will not be sufficient.

“Virtue cannot be regulated. Even the strongest supervision cannot guarantee good conduct. Essential will be the re-discovery of core values, and ultimately this is a question of individual responsibility,” said the Governor.

The Governor outlined progress underway on the implementation of the G-20’s financial reforms, which include measures that will help rebuild trust. New Basel III capital rules are being adopted, the reliance on ratings agencies is diminishing, and market infrastructure is being improved. As banks and their investors develop a better appreciation of their prospects for risk and return, business models are changing, and compensation practices are being reformed to more closely match rewards with risk profiles.

However, a spate of conduct scandals has overshadowed these improvements. This underscores the need for banks, regulators and other stakeholders to rebuild trust through a combination of institutional and individual initiatives.

Fundamentally, banks must reconnect with their ultimate clients in the real economy and rebuild core values within their institutions.

Making this reconnection begins with boards and senior management who need to define clearly the purpose of their organisations and promote a culture of ethical business throughout them. “But a top down approach is insufficient,” concluded the Governor. “Employees need a sense of broader purpose, grounded in strong connections to their clients and their communities,” and “bankers need to see themselves as custodians of their institutions, improving them before passing them along to their successors.”